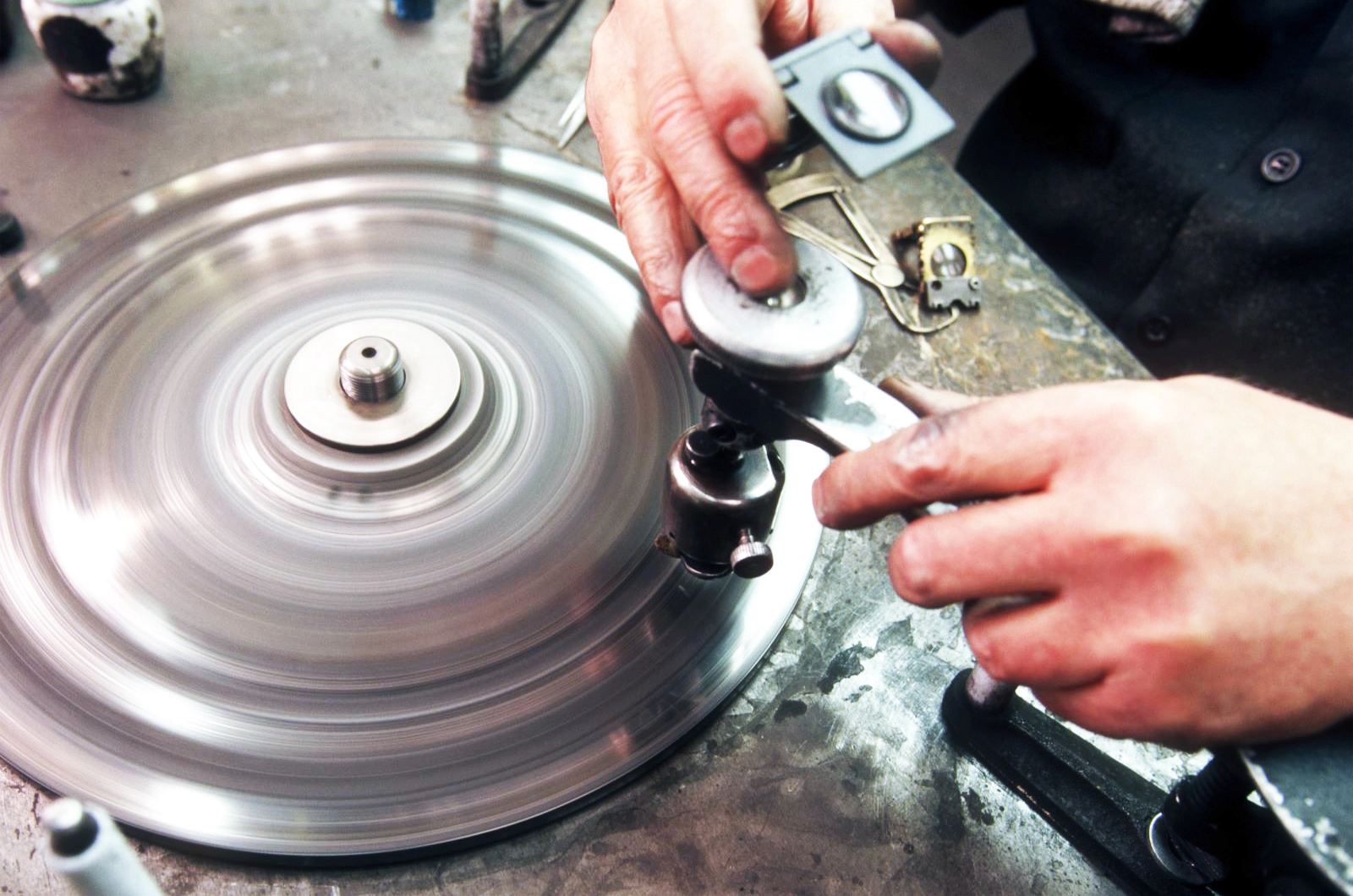

We work through a transparent supply chain to produce the most beautiful, well-cut diamonds with a vastly improved finish. Our technological breakthrough allows us to produce diamonds with superior luster, fire, and brilliance.

- We cut the most beautiful diamonds

- We sell natural and lab-grown diamonds

- We sell diamonds of every shape

- We sell at wholesale price

- We guarantee the lowest price

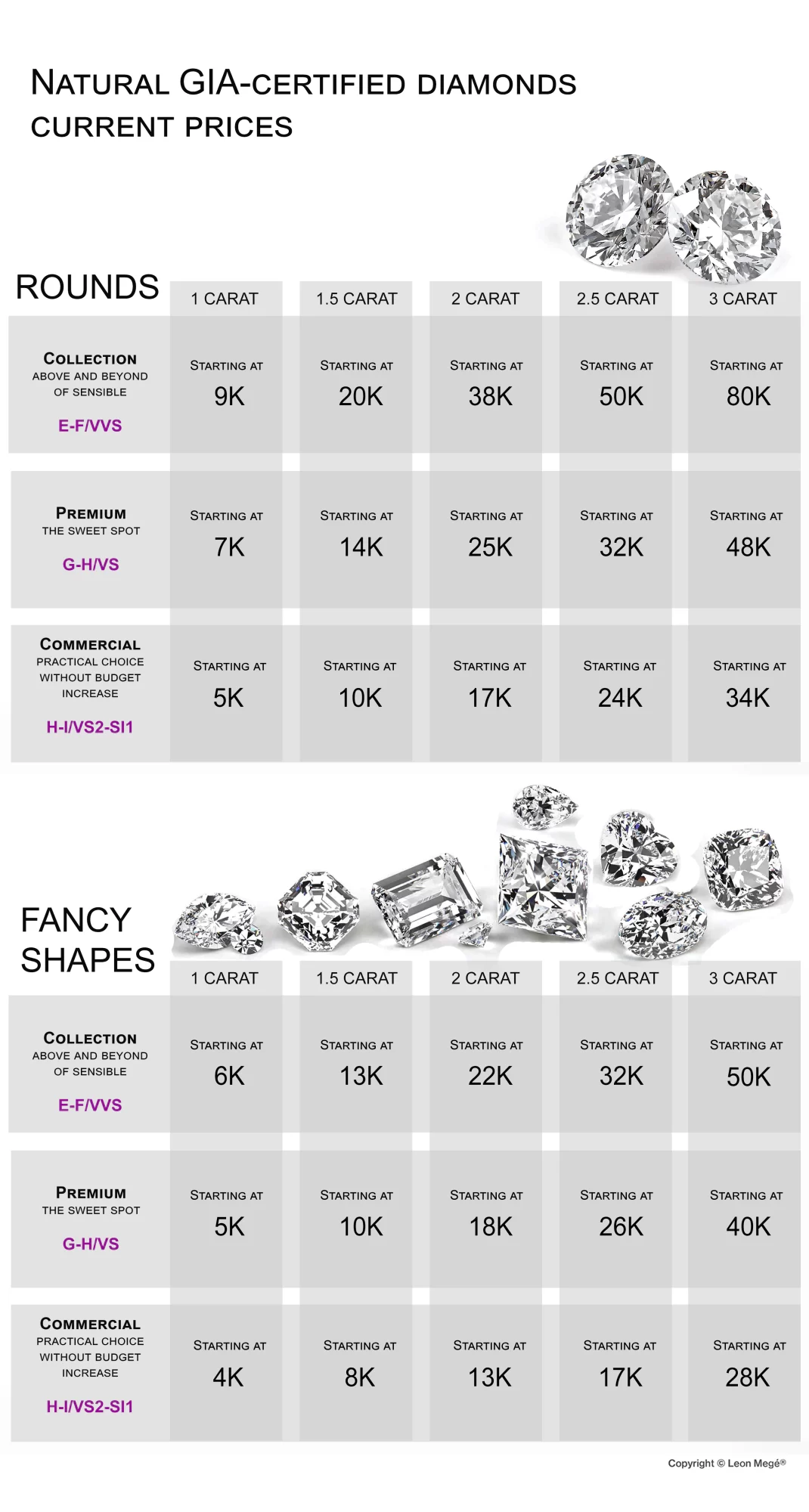

- We carry only GIA-certified diamonds

- We match a diamond to the ring style

- Diamond and custom work bundle savings

- We offer exclusive perks like free shipping, expedited completion, and unlimited consultations.

We only buy and sell conflict-free, ethically sourced diamonds from strictly vetted, legitimate sources in full compliance with the United Nations Kimberley process. Our gemologist assesses all diamonds before purchase. Our Jewelers Block insurance policy covers diamonds against loss or damage, including accidental damage during the setting.

Our standard diamond inspection include

- Visual inspection

- Microscopic examination

- Optical index calculation

- Market availability

- Ring design comparability

- Comparative pricing

Shop anywhere - Buy here

Every GIA-graded diamond can be traced by its certificate number – its unique identifier. As long as the diamond is listed on the Trade Network, we can supply it and even offer a better price. Retailers, brokers, and aggregators, such as BlueNile or James Allen, do not own diamonds; they resell stones owned by others, so-called “virtual” diamonds.

Technically you can buy any stone from any jeweler. As a protection against predatory shoppers who turn to the lowest bidder after the jeweler helped to identify and find the stone, the listing is removed to keep it out of the competitor’s hands. Calling several jewelers about the same diamond reduces your chances of getting a fair price because the owner will be less likely to negotiate knowing their stone is in demand.

Some retailers, such as Tiffany’s, resorted to issuing proprietary certificates that replace GIA originals to create an illusion that their diamonds are unavailable on the open market and make comparison shopping more complicated. This makes it harder to identify the individual diamonds but not entirely impossible.

Even worse are bottom-feeders from Pricescope selling AGS or EGL diamonds that are typically over-graded. Their certificates are not available online and cannot be verified.

The fascinated story of our Oompa-Loompas diamond cutters

Leon Mege diamond cutters came from a terrible borough infested with the most dangerous people in the world – diamond brokers who chew ten cutters on the price before breakfast and come galloping back for a second helping. They were living in constant fear of not getting paid. And they were doing sad business, spending every moment of their days going through the unpaid receipts. Poor diamond cutters! The one thing that they longed for more than anything else was a steady supply of rough diamonds. But they couldn’t get them. A diamond cutter was lucky if he found three or four rough crystals a year. But oh, how they craved them. They used to dream about diamonds all night and talk about them all day. You had only to mention the word diamond, and they would start dribbling at the mouth. As soon as Leon Mege discovered that the cutters were crazy about this particular resource, he went to Brooklyn and poked his head in through the office’s door belonging to the top cutter.

-“Look here,” he said (speaking not in English, of course, but in Yiddish), “look here, if you and all your cutters will come to the Diamond District, you can have all the rough you want! They’ve got mountains of it on 47th Street! You can gorge yourselves silly on the rough! I’ll even pay your wages in rough if you wish!”

-“You really mean it?” asked the manager, leaping up from his chair.

-“Of course I mean it,” Leon Mege said. “And you can have the faceted diamonds also as well. Faceted diamonds are even better because they are already pre-cut.”

The manager gave a great whoop of joy and threw his book of memos right out of the window.

-“It’s a deal!” he cried. “Come on! Let’s go!”

So he sent them all to Manhattan, every cutter. It was easy. He brought them to the city on a big yellow school bus, and they all got there safely. They are wonderful workers. They all speak English now. They still wear the same kind of clothes they wore in Brooklyn. They insist upon that.